On this episode, we're rounding up the latest crypto news we missed throughout the week and taking live viewer questions.

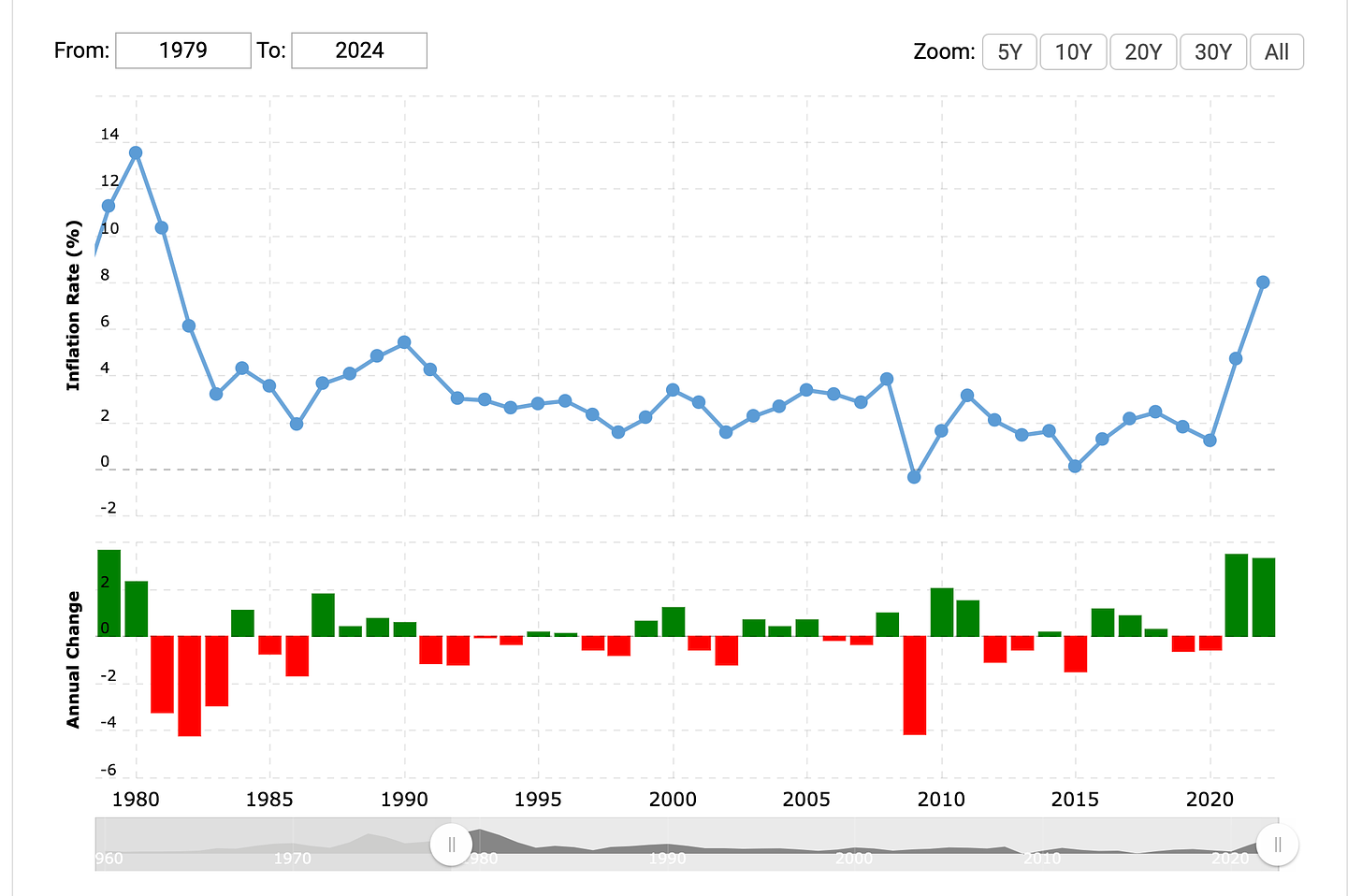

China's central bank recently cut rates in an attempt to boost its slowing economy. However, this comes when inflation continues to rise in the United States and other countries worldwide. This raises the question of whether inflation will ever reach the Fed target of 2%.

Several factors could contribute to continued inflation. One factor is the war in Ukraine, which has disrupted global supply chains and driven up energy prices. Another factor is the strong demand for goods and services, which puts upward pressure on prices. Additionally, the Fed's aggressive interest rate hikes could lead to higher inflation in the short term.

Despite these challenges, there are some reasons to believe that inflation will eventually come down. One reason is that the Fed is committed to returning inflation to its target level. The Fed also hopes the war in Ukraine will end soon, which would help alleviate supply chain disruptions and bring down energy prices.

However, it is essential to note that it is difficult to predict how long it will take for inflation to come down. The Fed has said it is prepared to keep interest rates high for as long as necessary to bring inflation back to its target level. This could mean that inflation stays elevated for some time.

Overall, it is too early to say whether inflation will ever reach the Fed target of 2%. Several factors could contribute to continued inflation, but the Fed is committed to bringing inflation back to its target level. It is important to note that it is difficult to predict how long it will take for inflation to come down.

Inflation from 1979 to 2024

Question: Will inflation ever reach the Fed target of 2%?

This is a difficult question to answer definitively. The Fed is committed to returning inflation to its target level, but several factors could contribute to continued inflation. The war in Ukraine, strong demand for goods and services, and the Fed's aggressive interest rate hikes all could lead to higher inflation in the short term.

However, it is essential to note that the Fed has a long track record of success in controlling inflation. The Fed also hopes the war in Ukraine will end soon, which would help alleviate supply chain disruptions and bring down energy prices.

Overall, it is likely that inflation will eventually come down to the Fed target of 2%. However, it is difficult to predict how long this will take. It is possible that inflation could stay elevated for some time, especially if the war in Ukraine continues or if there are other unexpected shocks to the economy.

This episode is sponsored by Tangem ➜ https://bit.ly/TangemPBN

Tangem is a card-shaped self-custodial cold wallet that gives you complete control of your private keys. Store, buy, earn, transfer, and swap 6000+ coins and tokens.

https://bit.ly/TangemPBN Use Code PBN for Additional Discounts!

Become a Diamond Circle Member FREE! ➜ https://bit.ly/PBDiamondCircle

Subscribe on YouTube ✅ https://bit.ly/PBNYoutubeSubscribe

Facebook 📱 https://bit.ly/PBNfacebook

X/Twitter 📱 http://bit.ly/PBNtwitter

Crypto Power Index Beta Access ➜ https://bit.ly/CryptoPowerIndex

Looking for the best tax havens for Crypto? Free month with iTrust Capital - Use PROMO CODE - PAUL BARRON https://rebrand.ly/PAULBARRON

Share this post