Currency War: China vs U.S. Dollar 💸 💶

The banking failures in the U.S. renewed questions about its susceptibility to destabilizing financial crises.

The banking failures in the U.S. renewed questions about its susceptibility to destabilizing financial crises. Meanwhile, China’s ties with Saudi Arabia have led to speculation of a petro-yuan that displaces the petrodollar. Russia’s economy, restricted from Western financial networks and the U.S. dollar, has embraced a burgeoning alternative: the Chinese yuan. Chinese banks are opening bank accounts for regulated crypto companies, with several acting as a payment layer for the crypto platforms. But where does Bitcoin ($BTC) fit into the currency war?

PBN Research

Buffet’s Sale of their TSM Stock

Since it produces most of its chips in Taiwan, it is the main reason why approximately two-thirds of worldwide chip production takes place on the island. It is the primary manufacturer for companies such as Qualcomm, Advanced Micro Devices, and Apple (AAPL 0.78%), Berkshire's largest holding.

Recovery on Track

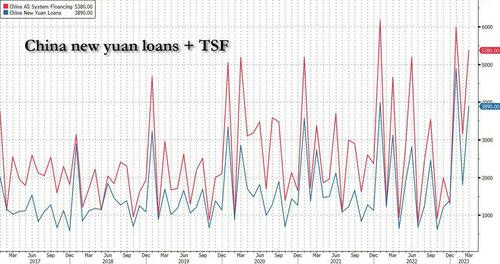

China's delayed "liftoff was imminent", and that "the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is - willingly or otherwise - set to serve as the world's growth dynamo at a time when the entire developed world is about to max out at the same time.

China’s State-affiliated Banks Onboarding Cryptocompanies

Bank of Communications, ZA Bank — Hong Kong’s largest virtual bank controlled by Chinese internet insurer ZhongAn Online P&C Insurance — will also act as the settlement bank for the crypto companies.