Silvergate Bank Collapse Causes Bitcoin Sentiment to Crash 🚑

Most of Silvergate Bank's crypto-friendly industry clients have left or are leaving the company after it warned of several headwinds and asked its auditors to review its books.

Most of crypto-friendly Silvergate Bank's (SI) industry clients have left or are leaving the company less than a day after it announced it would have to review its books with its auditors and warned of several headwinds. On the day's trading, the bank's share price has fallen more than 50%, to an all-time low. Silvergate's clients Coinbase, Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, and Gemini said they would suspend business with the bank. This might also prove to have more far-reaching short-term effects on the markets.

PBN Research

Coinbase Break up with Silvergate

The crypto exchange will facilitate institutional client cash transactions for its prime customers with its other banking partner, Signature Bank.

The stocks of Silvergate Bank, which were already under stress due to a delay in filing its annual 10-K report, dropped another 40% in pre-market trading. Silvergate Capital was also downgraded to “underweight” from “neutral” by JP Morgan in light of the insolvency scare.

Silvergate shares drop 30%

The bank initially posted a loss of $949 million for the final three months of 2022, which is now expected to increase.

“These additional losses will negatively impact the regulatory capital ratios of the Company and the Company’s wholly owned subsidiary, Silvergate Bank, and could result in the Company and the Bank being less than well-capitalised,” it wrote in the filing.

Liquidity Concerns

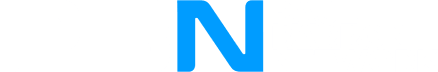

Order-book depth in the crypto market for Bitcoin and Ethereum hits new lows, even lower than the levels post-FTX collapse.

A major concern is an illiquid market that can have ramifications both to the upside and downside.

According to Kaiko, the market depth is now the lowest since the Terra collapse, which has dropped over 50% since October for both Bitcoin and Ethereum.

#Crypto #Bitcoin #ethereum